5 - Test your trading system

We offer two complementary methods to test your trading systems.

- ProBacktest: Backtest your systems using past data

- PaperTrading: test your system day after day in real market conditions

Simulate your strategies with ProBacktest

The ProBacktest module lets you simulate implementation of your strategy based on historical data in order to get an estimation of what its performance could have been.

As a result, the ProBacktest mode lets you confirm the performance of a system, based on the available information in the historical data, but also detect weaknesses to improve it.

Several years of historical intraday data

Backtesting your system on longer and more reliable data provides more relevant and useful results.

ProRealTime offers several years of intraday historical data. The reliability of this data is maintained by a team dedicated to full-time data maintenance and a direct connection to exchanges.

Launch a ProBacktest simulation with your trading system

Using ProBacktest is easy:

- Display the charting window of the instrument on which you want to backtest your system in the unit of time of your choice for the simulation (ex: 15 minutes).

- Use the "history" dropdown menu (at the top left of the chart) to load the amount of historical data you want to use (ex: 10 000 units).

- At the top of the chart, click on the

button then on the tab "ProBacktest & Automatic Trading" and select the system you want to backtest.

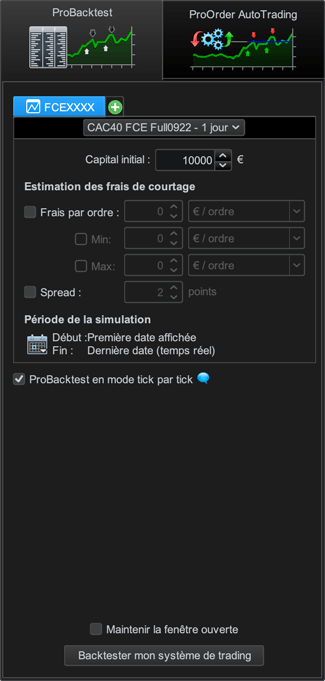

button then on the tab "ProBacktest & Automatic Trading" and select the system you want to backtest. - Click "Modify" to access the code editor window. From the "ProBacktest" tab, set the following parameters:

- Initial capital: enter the amount of initial capital for your simulation

- Brokerage parameters; set the brokerage fee which will apply to each transaction in the simulation (fixed amount, %, spread, etc.)

- Max position size defined in cash: This parameter only applies to orders to enter the market with the following limitations: checks concerning the "Max position size" in cash parameter are performed at the close of the bar that triggers a position entry in a trading system. Thus, this limit may be exceeded if the order to enter the market is an "at market" order and the execution price level is different from the close price of the previous bar. Max position size in cash may also be exceeded due to gains.

- Historical data used in the simulation: by default the system will be simulated on all of the data loaded in the chart. Use this option if you want to reduce the time period to simulate the system (ex: from January 1st, 2014 to June 30th, 2014).

- Then you just need to click the button "ProBacktest my system" to launch the simulation.

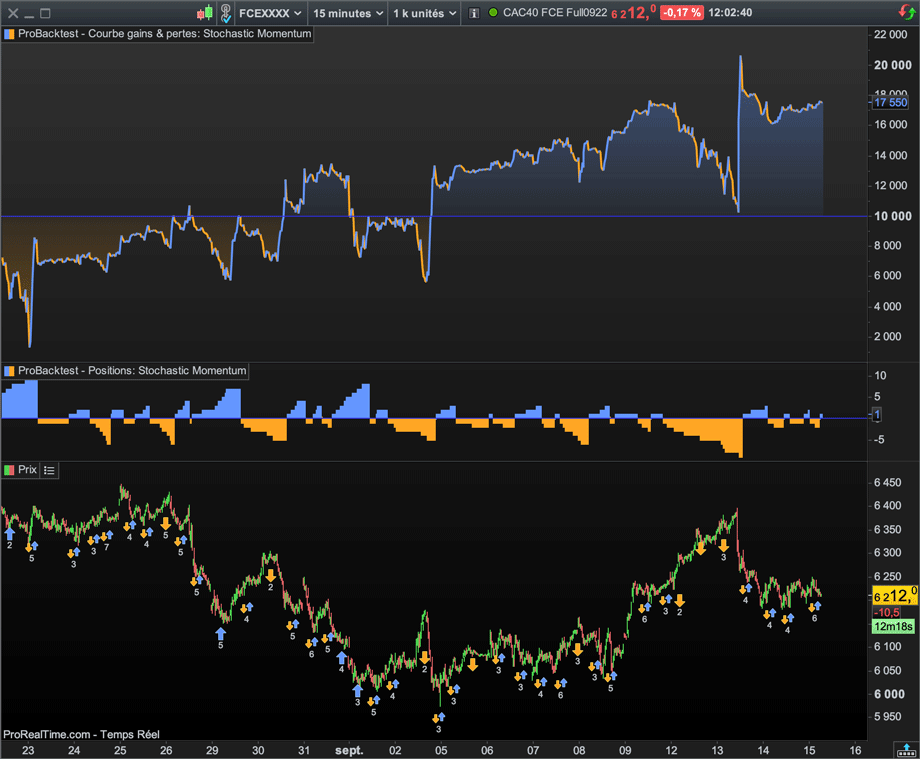

Analyze the results of the ProBacktest simulation

Once the trading system has been backtested, you can check:

- Its equity curve

- Its position history (in the form of charts)

- Its history of executed orders (in list form or chart form)

- A detailed statistic report

The detailed report will give you many useful statistics such as:

Analysis of gains

- Gain for the simulated period (in % and absolute)

- Gain/loss ratio

- % of winning positions

- Differentiated analysis for long and short positions

- ...

Analysis of positions

- Average time position held

- % of time in the market

- Average number of orders per day/month

- ...

Risk analysis

- Highest loss on a position

- Max. drawdown (historical max loss)

- Average exposure / Minimum exposure

- ...

To learn more about ProBacktest, go to page 23 of the trading systems programming manual.

Warning: the statics calculated with ProBacktest relate to past data. Past performance is not indicative of future results.